PLG Weekly #3: Ditch your 80s sales comp models for PLG, The PLG Upstart that's taking on WalkMe

Welcome to the third edition of the PLG weekly. We start with some 💥 insights from Mark Roberge at SaaStr.

📊 80’s comp models are hurting your product-led sales teams

If you’re a PLG company, your customers can expand product usage to multiple users inside a team and multiple teams inside the company quite easily because of the ease of use of buying and adding users to your product. For companies that are buying software, this leads to a new problem. SaaS Waste.

Companies are increasingly paying for apps that they aren’t using or optimizing.

Here’s what the general statistics for 2020 for Saas usage from Blissfully says:

A company subscribes to 3.6 duplicate apps on average. This is an 80% increase from last year.

The average company has 3.6 abandoned app subscriptions. This is an increase of 100% compared to last year.

5.4% of apps are not being used to their full extent.

The average amount wasted is $135,000 annually per company.

I’m sure the question on your mind is how do I as a vendor make sure my app doesn’t end up as SaaS waste. Mark Roberge suggests that you add this graph to your daily dashboards.

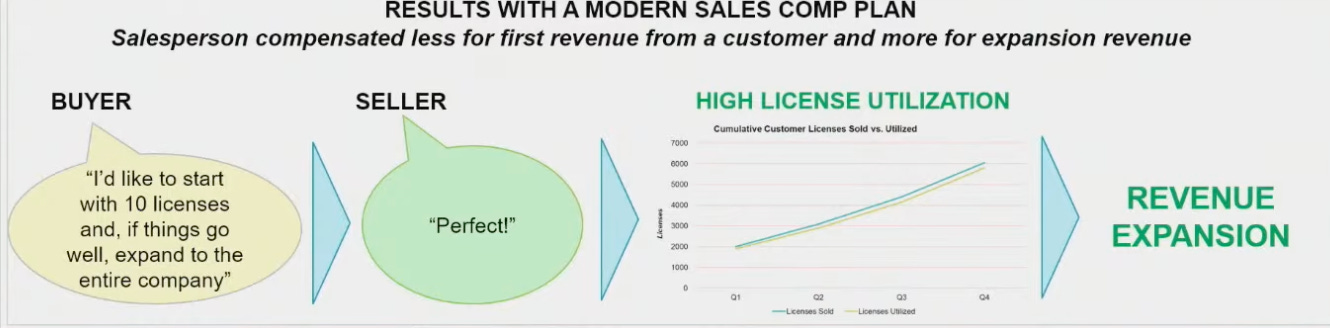

One of the primary reasons for low license utilization rates is outdated sales compensation models from the 1980s.

Since the 80s, most companies have comped sales teams more for first revenue from a customer and less for expansion revenue. This results in reps selling more licenses more than necessary.

At Hubspot and Stage 2 portfolio companies, Mark paid reps 20% more for expansion revenue than new revenue. This resulted in reps selling 100 seat accounts as 5 upfront and then selling the rest of the 95 seats through the quarter. Reps kept a close watch on these accounts and made sure they kept using the product. Also if a rep made a bad sale the cost is 5 seats and not 100 seats!

If you’re in sales/revenue ops, you should look at what the license utilization for your customer base and change your comp policy accordingly.

🎉 Tango, the PLG startup that’s revolutionizing the digital adoption space

According to Ken Babcock,

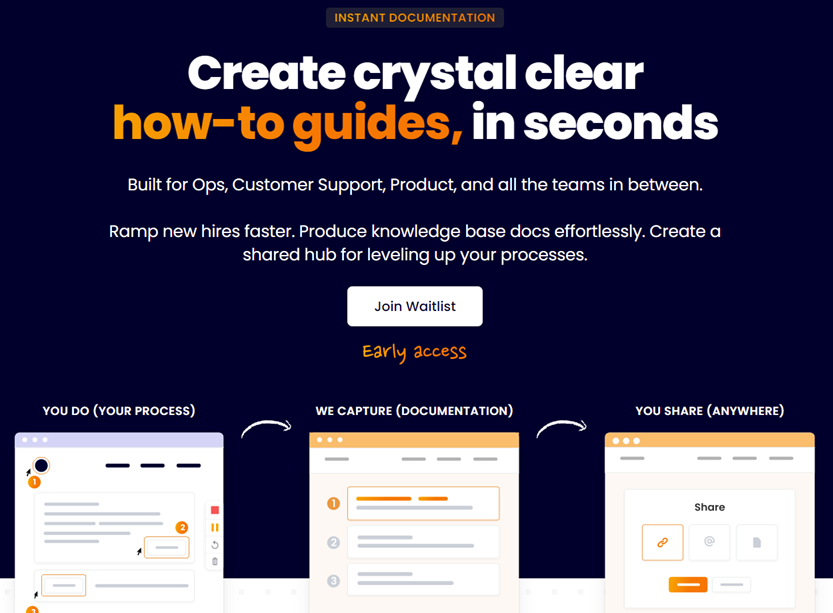

“Tango is the simplest way to create crystal clear how-to guides, in seconds. Our primary buyers, in support and sales, communicated a desire to reduce the burden of creating documentation (Workflows in the Tango-verse) as their organizations scale. One member of a recent pilot - a Quality and Knowledge Analyst for a support team split across multiple time zones - shared that using Tango reduces 40 hours worth of internal/external knowledge article creation down to 4 hours. That tangible, measurable value was abundantly clear to her. We realized that frontline employees on these teams would be our primary advocates and serve as a node within a company.”

I used to work as a solution engineer and one of the most time-consuming things was putting together how-to guides for both customers and my team. I’ve tried most solutions in the space and none of them are as intuitive as Tango or require talking to a sales team to just get access like WalkMe. It was high time that a new PLG alternative that you can try and buy was there in this space! I’m not the only one to feel this way :)

With a modern GTM motion and bottom-up adoption of Tango unlike their competitors, Tango can be the Loom/Monday.com equivalent of their space. If you’re looking at creating documentation to scale your company processes, you should check out Tango!

You’ve reached the end of this week’s edition and we hope you’ve enjoyed it. We’ll be publishing every Wednesday and if you like what you read this week, please subscribe.

Also if you like what you read, share it with anyone who might be interested in PLG.